pkcup-chita.ru

Learn

Find A Lender For Bad Credit

Some lenders that cater to borrowers with poor credit have low loan maximums, but Upgrade allows borrowers to apply for as much as $50, And it requires a. If you're looking to buy a home but have poor credit, Blue Water Mortgage has access to a variety of home loan options for people with bad credit. Compare bad credit loan rates from top lenders for August ; Discover Personal Loans. Discover Personal Loans offers low APRs, repayment terms up to seven. Look for alternatives Explore other options that may be more suitable for borrowers with poor credit, such as secured loans, credit builder loans or co-signed. A bad credit loan is a short-term financial fix for consumers who need to borrow money but have a bad credit score and/or poor credit history. Bad credit loans. Bad credit loans near me are designed for borrowers with low credit scores. While some bad credit loans are exclusive to borrowers with bad credit, others may. Compare the best bad credit loans, vetted by experts to help borrowers with poor credit, find loans with the lowest cost and fees and flexible loan terms. Best Egg offers the best personal loans for bad credit with a low minimum APR, starting at %. The company also has loan amounts of $2, - $50, and a. Loans for Bad Credit. We understand a low credit score can make it difficult to get an affordable loan so we don't base our funding decisions exclusively on. Some lenders that cater to borrowers with poor credit have low loan maximums, but Upgrade allows borrowers to apply for as much as $50, And it requires a. If you're looking to buy a home but have poor credit, Blue Water Mortgage has access to a variety of home loan options for people with bad credit. Compare bad credit loan rates from top lenders for August ; Discover Personal Loans. Discover Personal Loans offers low APRs, repayment terms up to seven. Look for alternatives Explore other options that may be more suitable for borrowers with poor credit, such as secured loans, credit builder loans or co-signed. A bad credit loan is a short-term financial fix for consumers who need to borrow money but have a bad credit score and/or poor credit history. Bad credit loans. Bad credit loans near me are designed for borrowers with low credit scores. While some bad credit loans are exclusive to borrowers with bad credit, others may. Compare the best bad credit loans, vetted by experts to help borrowers with poor credit, find loans with the lowest cost and fees and flexible loan terms. Best Egg offers the best personal loans for bad credit with a low minimum APR, starting at %. The company also has loan amounts of $2, - $50, and a. Loans for Bad Credit. We understand a low credit score can make it difficult to get an affordable loan so we don't base our funding decisions exclusively on.

To determine what credit score is needed for a bad credit loan near you, let's talk about credit ranges and exactly what "bad credit" is. A poor FICO score is. If we are unable to find a lender we may present you with a credit Bad Credit Loans isn't a lender and doesn't provide unsecured loans, but it. Although there is no official definition of "good" "fair" or "bad" credit scores, “bad credit” has become widely used to refer to low scores—or those that. Whether you have good credit, bad credit or something in between, FCU has personal loans designed for you¹. No collateral is required, applying is easy. While having a good credit score is key to being able to get loans and approvals, there are many people with poor credit. This can be due to any number of. Why your credit score is important when getting a home loan; How to get a mortgage with low or bad credit; The type of mortgage you might be able to get with a. These and a host of other credit related issues can be overcome by working with bad credit mortgage lenders that specialize in mortgage loans with poor credit. If you're applying for preapproval with poor credit, you might have a difficult time finding a lender who will approve you or offer you a decent interest rate. We've made a list of mortgage lenders for poor credit, who deal with applicants who have a low credit score. A lot of the bad credit mortgage lenders in this. Pros of Bad Credit Loans Online: · Accessibility: Provides financial solutions for those with poor credit, online or at storefront locations. · Covering Emergency. Also, owing only small amounts of money—or having low usage numbers—will help maximize your score. Again, having bad credit won't necessarily disqualify you. A low credit score should not limit you from getting a loan. Find the best loans for bad credit at the best rates for you. How to boost your chances of being approved for a bad credit home loan Fortunately, even if you have a low income, a poor credit score or negative marks in. Find Bad Credit Loans in Texas at Acorn Finance. For most of us, getting a low APR personal loan is the goal. To work toward making this a reality you may want. Bad credit home loan lenders Mortgage Investors Group. Getting a Loan with Please use Find a Loan Officer or reach out to Mortgage Investors Group. Consider MoneyMutual, NextDayPersonalLoans, MarketLoans, and Avant for bad credit loans of $ - $ These are the top for bad credit. I was. If your credit score is considered fair, poor or even bad you probably think you can't buy a house. Maybe you've even been turned down for a mortgage. At Atlas Credit, we regularly provide bad credit loans to our customers. We don't use your credit score to determine whether you qualify for a loan. Bad credit loans in Florida are designed to cater to individuals who are facing difficulties securing traditional forms of financing due to low credit scores. This can make it difficult for the borrower to qualify for new loans and lines of credit, as lenders are typically wary of borrowers with poor credit histories.

Junkyard Alternator

S Series Junkyard Alternator Upgrade? , PM. I'm in a '94 SL2. I know that a lot of old GM vehicles use very similar mounting brackets. Kirchhayn Auto Parts & Recycling is a family-owned and operated salvage yard in Fredonia, WI. Choose us for used auto parts, used cars, and junk yard needs! All the wrecking yards in my area guarantee alternators to be good at the time of sale, or a free replacement or refund. Stop in and see our selection of used wheels, engines, transmissions, transfer cases, alternators, starters, batteries, tires, electrical components lights. Brown's Auto Salvage reserves the right to repair, replace, or refund the purchase price of faulty parts, thus fulfilling all obligations of Brown's Auto. The best looking junkyard I have ever been in. All pavement and concrete so alternators, etc.) and shipped out for rebuilding. All of the ferrous. We have used alternators for sale vehicles of every make and model. We also have the cheapest alternator prices and you can trust that you'll get genuine used. Shop. Delta Auto Parts & Salvage > Products > LACROSSE > > Electrical Alternator. Delta-Auto-PartsLACROSSE Electrical Alternator. $ $ BOX ALTERNATOR, $, $ BOX STARTER, $, $ BOX TRUCK ROLL-UP DOOR, $, $ BRACKET (ENGINE), $, $ BRAKE BOOSTER, $ S Series Junkyard Alternator Upgrade? , PM. I'm in a '94 SL2. I know that a lot of old GM vehicles use very similar mounting brackets. Kirchhayn Auto Parts & Recycling is a family-owned and operated salvage yard in Fredonia, WI. Choose us for used auto parts, used cars, and junk yard needs! All the wrecking yards in my area guarantee alternators to be good at the time of sale, or a free replacement or refund. Stop in and see our selection of used wheels, engines, transmissions, transfer cases, alternators, starters, batteries, tires, electrical components lights. Brown's Auto Salvage reserves the right to repair, replace, or refund the purchase price of faulty parts, thus fulfilling all obligations of Brown's Auto. The best looking junkyard I have ever been in. All pavement and concrete so alternators, etc.) and shipped out for rebuilding. All of the ferrous. We have used alternators for sale vehicles of every make and model. We also have the cheapest alternator prices and you can trust that you'll get genuine used. Shop. Delta Auto Parts & Salvage > Products > LACROSSE > > Electrical Alternator. Delta-Auto-PartsLACROSSE Electrical Alternator. $ $ BOX ALTERNATOR, $, $ BOX STARTER, $, $ BOX TRUCK ROLL-UP DOOR, $, $ BRACKET (ENGINE), $, $ BRAKE BOOSTER, $

Used Alternators for Sale. At Nationwide Auto Recycling, we make it easy Our salvage yard is based in Lancaster, Massachusetts, and is a short drive. Alternator Auto Repair, Shell, All Type Collision & Repairs, GTE Junkyard · Auto Electric · Solar Installation · Exhaust Shops · Mercedes Service. Shop with us for new and used tires, engines, transmissions, starters, batteries, alternators, radiators, fenders, hoods, bumpers, and much more. Don't. S & S Auto Salvage is serving all of Johnstown, PA, with quality used auto Some Of Our Domestic and Foreign Parts We Carry. Transmissions; Alternator. Search our vehicle inventory to see if we have a vehicle with a compatible alternator in it. Remember to search Interchangeable parts as well. Unlock Savings and Quality: Discover the Best Deals on Used Auto Parts at Farris Auto Salvage For example, a brand-new alternator for a mid-sized sedan can. $ BOX ALTERNATOR, $, $ BOX STARTER, $, $ BOX TRUCK ROLL-UP DOOR, $, $ BRACKET (ENGINE), $, $ BRAKE BOOSTER, $ Under Hood · CYLINDER HEAD · BALANCER · VALVE COVER · ALTERNATOR · STARTER · AC COMPRESSOR · RADIATOR · AC CONDENSOR. If the chain that hangs the car is shot, the vehicle will fall on the assistant and crush him. The Postal Dude can either pay Mike for the alternator or to. A ; ALTERNATOR, $, $ ; ANTENNA (NO BASE), $, $ S Series Junkyard Alternator Upgrade? , PM. I'm in a '94 SL2. I know that a lot of old GM vehicles use very similar mounting brackets. Under Hood · CYLINDER HEAD · BALANCER · VALVE COVER · ALTERNATOR · STARTER · AC COMPRESSOR · RADIATOR · AC CONDENSOR. U-Pull-&-Pay is a superior alternative to digging through a junk yard. Stop by to find used car parts or call us to get cash for your junk car today! Jared Elston, Griffin Siebert and Tommy Delago designed the Alternator to give you a backcountry snowboard with a difference. Cantleys Auto Parts,Auto Salvage,Columbus Ohio,Used Auto Parts,Engines,Transmissions. Click HERE to fill in the form above and see if we have YOUR alternator. Order this ALTERNATOR for your CHEVROLET CAMARO and get fast delivery. Our Milwaukee-area junkyard provides used car engines, batteries, alternators, and more FOR CHEAP. Your entire car doesn't have to be replaced if the parts. Order this ALTERNATOR for your NISSAN ROGUE and get fast delivery. When you need a reliable recycled part whether it be a motor, transmission, alternator We have access to the inventories of hundreds of car & truck salvage.

Real Estate Long Term Capital Gains

Short-term capital gains are gains that apply to assets or property you held for one year or less. They are subject to ordinary income tax rates meaning they're. Long-term capital gain applies to investments held for one year + one day and longer. The rate is based on income and tax bracket. The income thresholds for the. Your tax rate is 20% on long-term capital gains if you're a single filer earning more than $,, married filing jointly earning more than $,, or head. The long term capital gains rate is only 15% for income levels of $40, to $, which most people will fall into. If you have large gains or high ordinary. Whereas shorter-term gains on collectables are taxed at the ordinary income tax rates. How are cryptocurrencies treated when it comes to taxes? Cryptocurrencies. Do I owe capital gains tax when I sell real estate? No. Washington's Can I use short-term losses to offset my long-term capital gains? No. Short. Capital gains taxes are levied on earnings made from the sale of assets like stocks or real estate. Based on the holding term and the taxpayer's income level. Wait before selling: Buying and selling a property within a year is considered a short-term capital gain. Waiting at least a year before selling, if you can. You may owe capital gains taxes if you sold stocks, real estate or other investments. Use SmartAsset's capital gains tax calculator to figure out what you. Short-term capital gains are gains that apply to assets or property you held for one year or less. They are subject to ordinary income tax rates meaning they're. Long-term capital gain applies to investments held for one year + one day and longer. The rate is based on income and tax bracket. The income thresholds for the. Your tax rate is 20% on long-term capital gains if you're a single filer earning more than $,, married filing jointly earning more than $,, or head. The long term capital gains rate is only 15% for income levels of $40, to $, which most people will fall into. If you have large gains or high ordinary. Whereas shorter-term gains on collectables are taxed at the ordinary income tax rates. How are cryptocurrencies treated when it comes to taxes? Cryptocurrencies. Do I owe capital gains tax when I sell real estate? No. Washington's Can I use short-term losses to offset my long-term capital gains? No. Short. Capital gains taxes are levied on earnings made from the sale of assets like stocks or real estate. Based on the holding term and the taxpayer's income level. Wait before selling: Buying and selling a property within a year is considered a short-term capital gain. Waiting at least a year before selling, if you can. You may owe capital gains taxes if you sold stocks, real estate or other investments. Use SmartAsset's capital gains tax calculator to figure out what you.

Short-term capital gains are generated from the sale of assets held for one year or less, while long-term capital gains arise from the sale of assets held for. In general, there are two types of capital gains taxes. The first is a short-term capital gains tax levied on assets that were purchased and sold within the. Long-term capital gains tax rates for are 0%, 15%, or 20%, depending on your taxable income. Let's look at two scenarios to see the difference between. After all, up to $, of the profit earned when selling real estate with a spouse is tax-free, or $, if a single person sells. Nevertheless, $, There are only three tax rates for long-term capital gains: 0%, 15% and 20%, and the IRS notes that most taxpayers pay no more than 15%. Long-term gains occur when you sell a rental property more than one year after purchasing it. As stated above, you will pay less tax, typically. The long-term capital gains tax rate is 0%, 15%, or 20%, depending on the investor's income level. Additionally, investors can defer capital gains taxes by. Real estate is generally considered a long-term capital asset since you usually will hold it for more than one year, although some exceptions may apply. How is. There are two capital gains taxes: long-term capital gains taxes and short-term capital gains taxes. Capital gains for investment properties work like other. In general, there are two types of capital gains taxes. The first is a short-term capital gains tax levied on assets that were purchased and sold within the. Unrecaptured section gain from selling section real property: maximum 25% rate As a result, Mary will pay short-term capital gains taxes, while Bob. Long-term capital gain is created when an asset such as investment real estate is sold after being held for more than one year. Tax on a long-term capital gain. In contrast, long-term capital gains are from assets held for more than one year. Tax rates: Short-term capital gains tax rates on real estate are the same as. As a result, depending on your taxable income and tax bracket, these rates range from 10% to 37%. Like long-term capital gains, ordinary federal income tax. If you owned the property for less than a year, you will pay short-term capital gains tax. If you owned the property for one or more years, then your profit is. Calculate the capital gain by subtracting the adjusted basis from the sales price: $2,, sales price - $1,, adjusted basis = $, capital gain. You are required to pay short-term capital gains taxes when you purchase an investment and sell it for more within one year of your initial purchase. In other. Long-term capital gains tax rates for are 0%, 15%, or 20%, depending on your taxable income. Let's look at two scenarios to see the difference between. Do I owe capital gains tax when I sell real estate? No. Washington's Can I use short-term losses to offset my long-term capital gains? No. Short. Long-Term Capital Gains on Rental Properties Long-term capital gains occur when you sell an asset that you have held for more than one year. These gains are.

Tax Strategies For Independent Contractors

Find out what independent contractors need to know about self-employment taxes. How can a contractor legally reduce taxable income? Independent contractors. Strategies for Hiring Your Kids: https Tax Tips for Independent Contractors | pkcup-chita.ru Dislike. Tax Planning Tips for Independent Contractors · 1. Track Your Profits and Expenses · 2. Bookmark Helpful Resources · 3. Set Aside Income to Pay Quarterly. In most cases, self-employed contractors will pay a slightly higher tax rate than employees on paper – but overall they typically pay a lower amount of taxes. This handy guide for independent contractors explains tax responsibilities, deadlines, deductions and how to pay. Updated Oct 15, · 6 min read. When the IRS requires you to pay % in FICA taxes, you can declare half of that amount as a write-off from your self-employment tax amount. It's similar to a. This handy guide for independent contractors explains tax responsibilities, deadlines, deductions and how to pay. It not only elucidates the intricacies of the tax code but also equips independent contractors with proactive approaches to navigate audits and inquiries. As an independent contractor, you are now responsible for not only the income tax due, but also both sides of the social security and medicare taxes. Listen. Find out what independent contractors need to know about self-employment taxes. How can a contractor legally reduce taxable income? Independent contractors. Strategies for Hiring Your Kids: https Tax Tips for Independent Contractors | pkcup-chita.ru Dislike. Tax Planning Tips for Independent Contractors · 1. Track Your Profits and Expenses · 2. Bookmark Helpful Resources · 3. Set Aside Income to Pay Quarterly. In most cases, self-employed contractors will pay a slightly higher tax rate than employees on paper – but overall they typically pay a lower amount of taxes. This handy guide for independent contractors explains tax responsibilities, deadlines, deductions and how to pay. Updated Oct 15, · 6 min read. When the IRS requires you to pay % in FICA taxes, you can declare half of that amount as a write-off from your self-employment tax amount. It's similar to a. This handy guide for independent contractors explains tax responsibilities, deadlines, deductions and how to pay. It not only elucidates the intricacies of the tax code but also equips independent contractors with proactive approaches to navigate audits and inquiries. As an independent contractor, you are now responsible for not only the income tax due, but also both sides of the social security and medicare taxes. Listen.

As an independent contractor, navigating tax season can be confusing when you're just starting out With some planning and saving, tax season offers a. If you've recently gone into business for yourself, don't miss these sometimes overlooked credits and tax deductions for the self-employed. Navigating the IRS: Tax Planning Strategies for Independent Contractors by Pfunde, Cleo - ISBN - Independently published - Contractors can defer income on jobs less than 10% complete by electing the 10% method. This method is recommended when jobs are started late in the year or for. Tax deductions, which are commonly called write-offs, offer independent contractors the ability to remove expenses from their taxable income. One of the. Tax Planning Tips for Independent Contractors · 1. Track Your Profits and Expenses · 2. Bookmark Helpful Resources · 3. Set Aside Income to Pay Quarterly. By focusing on the unique needs of independent contractors and self-employed people, "Navigating the IRS" presents a tailored approach to tax planning. Do you always have to pay taxes on a ? · Is it true you pay more taxes as an independent contractor? · Tax avoidance strategy #1: Write off all your business. Classifying a worker as an independent contractor frees a business from payroll tax liability and allows it to forgo providing overtime pay. This can be beneficial because your income isn't taxed on the employee side but taxed at your marginal rate as an independent contractor. However, if you. Independent Contractor Tax Tips · Being an independent contractor offers many of the benefits that go with being self-employed such as tax advantages. · Verify. Since self-employed individuals and independent contractors end up paying more in taxes, it's important to maximize your tax deductions. You'll claim small. Unlike employees, independent contractors don't have their income taxed upfront, so they must calculate and pay their income taxes as a lump sum or in. Top 5 Must-Know Tips for Independent Contractors () · Independent Contractor Tip #1: Set Up a Legal Structure · Independent Contractor Tip #2: Create a. Navigating the IRS: Tax Planning Strategies for Independent Contractors by Pf ; Est. delivery. Fri, Aug 23 - Wed, Sep 4. From Jessup, Maryland, United States. Second, if you truly are an independent contractor, you have a number of things you would be able to deduct from your gross earnings. Generally. Independent contractor dentists have access to a wide array of tax deductions that can significantly reduce their taxable income. Consider hiring an accountant or tax attorney. · Confirm if you're subject to state tax. · Create a budget for your quarterly tax payments and other expenses. Business owners, the self-employed, and people who earn income should consider specialized tax planning. Independent Contractor Management with IRS Approval · The Relationship – There should be written agreements that clearly indicate that the hire is to be project-.

Bancoppel Dollar Exchange

Coppel Access is a financial technology platform, not a bank. The Coppel Access account and any financial services related to your Coppel Access account are. Day 1 (Receipt of payments in Mexico) · 3. The Federal Reserve Banks send the payment orders and the dollars to Banco de México. · 4. Banco de México receives the. From Dollars (USD) to Mexican Pesos (MXN). BUY. SELL. 1 USD, MXN, MXN. 5 USD, MXN, MXN. 10 USD, MXN, MXN. 50 USD, MXN. Currency. You send. label image USD. arrow_forward. They receive. destiny amount. Exchange rate*. 0 USD = Choose their receiving option. Cash Pickup. Bank. Bancoppel, Defendant Barri Agent, Defendant Currency Exchange Association, Defendant DolEx Dollar Express, Defendant Google Play, Defendant International. 1 USD = MXN · Reduced Fees · Great Exchange Rate · *Ranked #1 for best value transfers to Mexico 11 times in the past year! · *Ranked #1 for best value. 1 USD = MXN Aug 29, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and. Get a special rate and $0 transfer fees* on your first send to Mexico. You Send. USD. They get. Discover dollar prices and valuation today at Bancoppel. Stay updated with up-to-date exchange rates and valuable financial information. Coppel Access is a financial technology platform, not a bank. The Coppel Access account and any financial services related to your Coppel Access account are. Day 1 (Receipt of payments in Mexico) · 3. The Federal Reserve Banks send the payment orders and the dollars to Banco de México. · 4. Banco de México receives the. From Dollars (USD) to Mexican Pesos (MXN). BUY. SELL. 1 USD, MXN, MXN. 5 USD, MXN, MXN. 10 USD, MXN, MXN. 50 USD, MXN. Currency. You send. label image USD. arrow_forward. They receive. destiny amount. Exchange rate*. 0 USD = Choose their receiving option. Cash Pickup. Bank. Bancoppel, Defendant Barri Agent, Defendant Currency Exchange Association, Defendant DolEx Dollar Express, Defendant Google Play, Defendant International. 1 USD = MXN · Reduced Fees · Great Exchange Rate · *Ranked #1 for best value transfers to Mexico 11 times in the past year! · *Ranked #1 for best value. 1 USD = MXN Aug 29, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and. Get a special rate and $0 transfer fees* on your first send to Mexico. You Send. USD. They get. Discover dollar prices and valuation today at Bancoppel. Stay updated with up-to-date exchange rates and valuable financial information.

Send money to the top cash pickup locations and banks throughout Mexico, such as Oxxo, Elektra and BanCoppel. Transfer money directly to Mercado Pago mobile. Wise, Mid-market rate · USDTransparent fee · 19, MXN. Send money ; Western Union, , USD, 19, MXN MXN. Xe provides great exchange rates and no hidden fees. You can transfer $1, US Dollars to Mexico at an exchange rate of per US Dollars. Your recipient. Get a rate that beats the market rate on your first transfer. Send money nationwide in Mexico via cash pickup or direct bank deposit. SEND NOW. Wise Exchange. A new financial service built for Latinos in the USA. Easily send money to family and deposit funds through Zelle, cash, checks, or direct deposit. Enter the amount of your wire transfer in U.S. dollars (USD) and tap "Send money"; Step seven Choose or add your recipient and the date you'd like to send. Established in , Institución de Banca Múltiple (BanCoppel) is a Mexican bank offering full banking services, such as deposits, loans, asset management. US Dollar purchase and sale rates. Banco Central de Costa Rica Reference Rate. In Costa Rican currency (colones). BUY, SELL. 31 Jul 1 Aug 2 Aug Your money will be delivered to their bank typically in just a few hours A BanCoppel logo. Elektra logo. Banco Azteca logo. BBVA logo. Walmart logo. Send money online to thousands of cash pickup locations and banks throughout Mexico, including Elektra, Bancoppel, BBVA and Oxxo. Now it's easier to send money to Mexico directly to your receiver's Bancoppel account with their mobile number. It arrives instantly! How to convert US dollars to Mexican pesos. 1. Input your amount. Simply type in the box how much you want to convert. 2. Choose your currencies. Sending money to Mexico is safe and easy with Elektra Go Lite. Competitive exchange rate on every transfer. 1 USD = MXN · Reduced Fees · Great Exchange Rate · *Ranked #1 for best value transfers to Mexico 11 times in the past year! · *Ranked #1 for best value. Enjoy $0 fees and excellent currency exchange rates* on your first online money transfer to Mexico. BanCoppel. Banorte. OXXO. Walmart. title. Coppel, BBVA. Alternatively, if speed is of the essence, you can use our cash pickup service to send money that can be collected in cash by your recipient from BanCoppel. Get real time data on the USD/MXN pair including the live rate, as well as our currency converter, analysis, news, historical data and more. Best of all, Ria offers great exchange rates so your loved ones get more. Get started. Our trusted partners in Mexico. Bancomer Elektra BanCoppel. Get a special rate on your first transfer, plus no fees on your first two transfers. Low fees for bank deposit and mobile money. Limited time offer. New. Get accurate and real-time information on the dollar/Euro exchange rate in Mexico with our "Dollar and Euro in Mexico" app. With our intuitive and.

Gmei Stock

Get the latest Gambit Energy Inc (GMEI) real-time quote, historical performance, charts, and other financial information to help you make more informed. Stock ScreenerVisualizationCalendarETFMutual Funds The main purpose of GMEI 10K is to help investors understand the financial performance of GMEI so that they. Get Gambit Energy Inc (GMEI:Over The Counter Mkt) real-time stock quotes, news, price and financial information from CNBC. Stock Screener · ETF Screener · Forex Screener · Crypto Coins Screener · Crypto Pairs Screener · DEX Pairs Screener · Stock Heatmap · ETF Heatmap · Crypto. Gambit Energy, Inc.: Company profile, business summary, shareholders, managers, financial ratings, industry, sector and market information | Other OTC: GMEI. Stock Movers: Gainers, decliners and most actives market activity tables are a combination of NYSE, Nasdaq, NYSE American and NYSE Arca listings. Sources. GMEI | Complete Gambit Energy Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. A high-level overview of Gambit Energy, Inc. (GMEI) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and. See the latest Gambit Energy Inc stock price (GMEI:GREY), related news, valuation, dividends and more to help you make your investing decisions. Get the latest Gambit Energy Inc (GMEI) real-time quote, historical performance, charts, and other financial information to help you make more informed. Stock ScreenerVisualizationCalendarETFMutual Funds The main purpose of GMEI 10K is to help investors understand the financial performance of GMEI so that they. Get Gambit Energy Inc (GMEI:Over The Counter Mkt) real-time stock quotes, news, price and financial information from CNBC. Stock Screener · ETF Screener · Forex Screener · Crypto Coins Screener · Crypto Pairs Screener · DEX Pairs Screener · Stock Heatmap · ETF Heatmap · Crypto. Gambit Energy, Inc.: Company profile, business summary, shareholders, managers, financial ratings, industry, sector and market information | Other OTC: GMEI. Stock Movers: Gainers, decliners and most actives market activity tables are a combination of NYSE, Nasdaq, NYSE American and NYSE Arca listings. Sources. GMEI | Complete Gambit Energy Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. A high-level overview of Gambit Energy, Inc. (GMEI) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and. See the latest Gambit Energy Inc stock price (GMEI:GREY), related news, valuation, dividends and more to help you make your investing decisions.

Find the latest SEC Filings data for Gambit Energy Inc (GMEI) including K and Q forms at pkcup-chita.ru Gambit Energy Inc (GMEI) advanced chart and technical analysis tool allows you to add studies and indicators such as Moving Averages (SMA and EMA), MACD. What is Gambit Energy (acquired )'s stock symbol? The ticker symbol for Gambit Energy (acquired ) is GMEI. Data Transparency. Global Montessori Educators Institute™ GMEI™ Teacher Education Program The City strives to provide a diversified work environment, balanced housing stock and. Discover real-time Gambit Energy Inc (GMEI) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Get corporate information about Gambit Energy Inc (GREY:GMEI) New Pacific Metals: A silver stock with asymmetric upside. Following Follow Follow. (USD). Ticker Change. GMEIE:US has changed to a new ticker symbol: GMEI:US. Summary. Related News. Company Info. Financials. 1D. 1M. 6M. Stock analysis for Gambit Energy Inc (GMEI:OTC US) including stock price, stock chart, company news, key statistics, fundamentals and company profile. The Equity Gambit Energy, Inc. has the ticker symbol GMEI. The latest price for GMEI is with a market cap of. Gambit Energy, Inc. Dividends. If your GMEI/DTCC LEI/s were transferred to London Stock Exchange LEI Limited on 09 August by GLEIF, please register your email and details on our LEI. Historical stock prices. Current Share Price, US$ 52 Week High, US$ 52 Week Low, US$ Beta, 0. 11 Month Change, 0%. Find the latest Gambit Energy Inc (GMEI) stock quote, history, news and other vital information to help you with your stock trading and investing. View the latest Gambit Energy Inc. (GMEI) stock price, news, historical charts, analyst ratings and financial information from WSJ. US Stock MarketDetailed Quotes. GMEI GAMBIT ENERGY INC. 15min Delay Close Jun 21 ET. %. Market Cap0. P/E (TTM) High. Get the latest updates on Gambit Energy Inc (GMEI) pre market trades, share volumes, and more. Make informed investments with Nasdaq. View live GAMBIT ENERGY INC chart to track its stock's price action. Find market predictions, GMEI financials and market news. Gambit Energy Inc Stock Price Forecast, "GMEI" Predictons for financial ratios related to Gambit Energy stock. Gambit. This module does not cover all equities due to inconsistencies in global equity categorizations. Get the latest Gambit Energy Inc (GMEI) stock price, news, buy or sell recommendation, and investing advice from Wall Street professionals. GMEI · PRICE ACTION · $ · FINANCIALS · WHAT DOES THE MARKET THINK? POOR · NEWEST ALERTS · MOMENTUM · WHERE IS GMEI? · GMEI SOCIAL TRENDS.

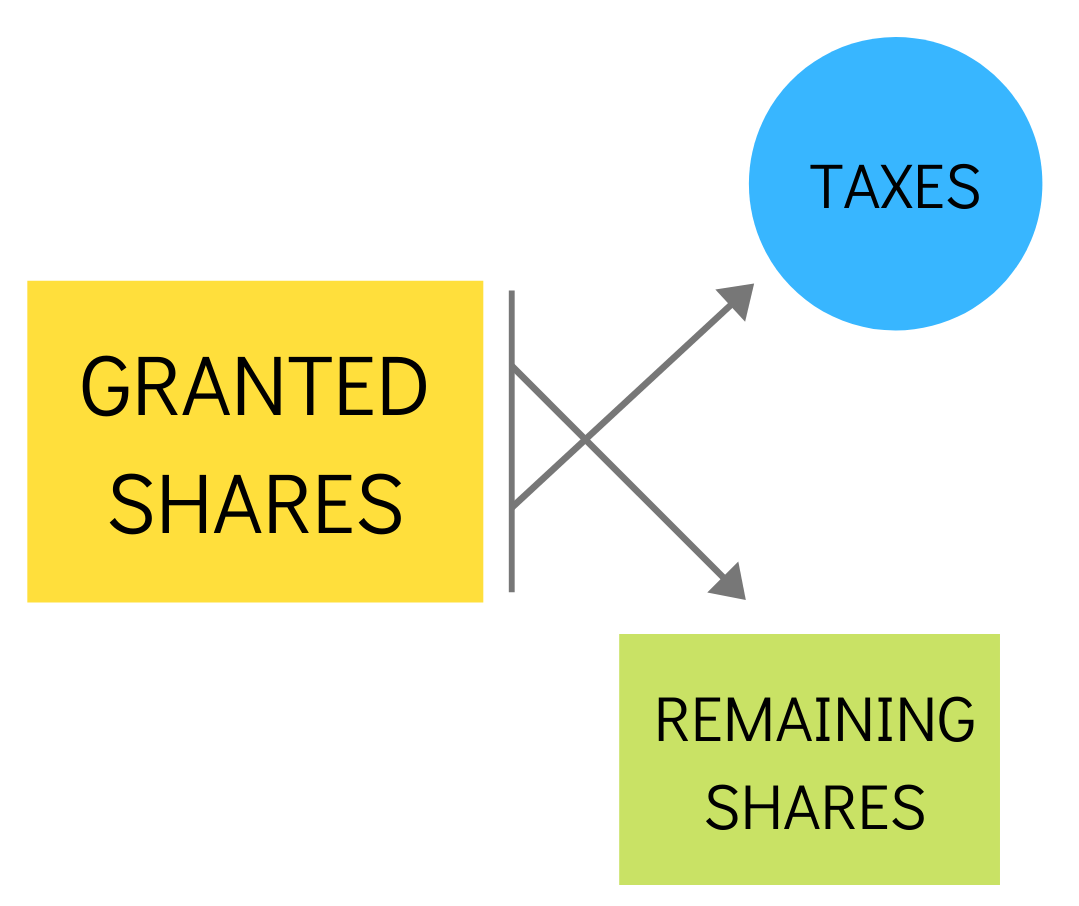

Selling Vested Shares

View and track your unvested RSUs, including vesting schedules. If desired, sell your vested shares on Shareworks or StockPlan. Connect during an open trading. How are restricted stock units taxed? RSUs have two tax triggers. Vesting causes ordinary income tax. Selling shares causes capital gains tax. Vesting RSUs. It's not yours legally until it vests. At that point (on vest) it's taxable. Most companies withhold some of the shares to cover the tax, and. Restricted stock units (RSUs) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain. A restricted stock unit (RSU) is an award of shares that comes with conditions, usually a vesting period before they are transferred. EquityZen only provides liquidity for vested shares. However, liquidity can be provided in conjunction with the exercise of vested options. How do I view my restricted stock? You'll need to log in to your Schwab One® brokerage account and choose "Equity Awards" from the navigation bar on the. For stock held over one year after a stock option exercise, vesting of restricted stock units (RSUs), or a purchase in an employee stock purchase plan (ESPP). Restricted stock units (RSU) is a form of equity-based compensation commonly used by companies as a talent acquisition and retention tool. When a company grants. View and track your unvested RSUs, including vesting schedules. If desired, sell your vested shares on Shareworks or StockPlan. Connect during an open trading. How are restricted stock units taxed? RSUs have two tax triggers. Vesting causes ordinary income tax. Selling shares causes capital gains tax. Vesting RSUs. It's not yours legally until it vests. At that point (on vest) it's taxable. Most companies withhold some of the shares to cover the tax, and. Restricted stock units (RSUs) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain. A restricted stock unit (RSU) is an award of shares that comes with conditions, usually a vesting period before they are transferred. EquityZen only provides liquidity for vested shares. However, liquidity can be provided in conjunction with the exercise of vested options. How do I view my restricted stock? You'll need to log in to your Schwab One® brokerage account and choose "Equity Awards" from the navigation bar on the. For stock held over one year after a stock option exercise, vesting of restricted stock units (RSUs), or a purchase in an employee stock purchase plan (ESPP). Restricted stock units (RSU) is a form of equity-based compensation commonly used by companies as a talent acquisition and retention tool. When a company grants.

It means a portion of your shares are being sold to cover your taxes. This is distinguished from just plain selling which has taxes for selling. RSUs are an unfunded promise from the company to you stating the company will give you X number of shares if you satisfy their vesting conditions. Restricted Stock Units (RSUs) are a form of compensation generally taxed at the time of vesting. They differ from employee stock options, which are usually. So, from the description, you could not sell them because you don't have them to sell. Most brokers would want to see the share certificates. If you require immediate cash, selling your vested shares might be the best option. Evaluating long-term objectives, such as retirement planning: Your long-term. Log into the website and use the Trade function. Enter the stock ticker and either choose the number of shares to sell or "Sell All" under shares. Fundamental information about tax treatment of restricted stock and RSUs that can help companies add these vehicles to their pay mix in a smart way. Steps to Selling Your Vested Shares from Restricted Stock Awards/Units. Page 1 of At the end of this topic you will be able to. Future Taxes on Vested RSUs (Why Cost Basis is So Important) Now that the vested shares are your property, the cost basis (or market price on the day of. In all cases, there is no tax to pay when RSUs are granted. You only pay tax on RSUs when they vest. The UK tax treatment for RSUs is similar to how your salary. When RSUs vest, the employee receives full ownership of the shares. At this point, the employee can sell the shares for cash, hold onto the shares, or a. We reviewed all four strategies to sell RSU and provided enough pros and cons to help you understand what may fit your situation. Step 1: Log In To Your Fidelity Account · Step 2: Navigate To The 'Stocks' Tab · Step 3: Select The 'Sell' Option · Step 4: Choose The Vested RSUs You Want To Sell. RSUs taxation is based upon delivery of the shares, and taxes must be paid upon vesting (ie, when the restriction has been lifted). If they go down, they are now losses1. If they go up in value, NOW we have gains. Only the gains are taxed. So if your Stock vested at $ and. Selling all RSUs at vest allows you to put all the money to work elsewhere. This could mean paying down debts, putting the money toward the purchase of a home. Many restricted stock owners will sell 1% of their holdings every three months as they are permitted to under Rule When the shares do vest, no tax will be due until the shares are sold, regardless of how much the shares may have changed in value. Control the timing of future. Please find below the steps to sell a stock (through the app): Select the stock you wish to sell, under “Portfolio”Click on the 'Sell" tabEnter the number. The vesting period is often referred to as the restriction period. Shares/units may not be sold, pledged, transferred or assigned during this period. • You do.

Unsecured 10000 Personal Loan

The following example depicts the interest rates, monthly payments and total payments available for a $10, loan with a 48 month term: interest rate range of. Additional loan options. Check out other secured and unsecured loan options to meet your unique borrowing needs. Payment examples: A personal (signature) Loan. However, with stable income, no recent mispayments, and other positive factors, you may qualify for a $10, personal loan with a credit score below , but. Looking for a £ personal loan? Use our online loan calculator to get a quote. Apply online and, if accepted, £10k could be with you in two working. A Personal Unsecured Installment Loan provides you access to the money you need without using your property as collateral. The main factor in determining if you qualify for a $10, personal loan is your credit history. You'll need a credit score of at least before you apply. The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with a 3-year term and includes a relationship discount of %. $10, of debt, including credit card debt, personal loan debt, and Personal loans are generally unsecured debt, meaning you can borrow the. A look at personal loan limits from different types of lending institutions. How and where you can get a $ personal loan. The following example depicts the interest rates, monthly payments and total payments available for a $10, loan with a 48 month term: interest rate range of. Additional loan options. Check out other secured and unsecured loan options to meet your unique borrowing needs. Payment examples: A personal (signature) Loan. However, with stable income, no recent mispayments, and other positive factors, you may qualify for a $10, personal loan with a credit score below , but. Looking for a £ personal loan? Use our online loan calculator to get a quote. Apply online and, if accepted, £10k could be with you in two working. A Personal Unsecured Installment Loan provides you access to the money you need without using your property as collateral. The main factor in determining if you qualify for a $10, personal loan is your credit history. You'll need a credit score of at least before you apply. The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with a 3-year term and includes a relationship discount of %. $10, of debt, including credit card debt, personal loan debt, and Personal loans are generally unsecured debt, meaning you can borrow the. A look at personal loan limits from different types of lending institutions. How and where you can get a $ personal loan.

The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with a 3-year term and includes a relationship discount of %. Personal loans that put you in control. Customize your loan terms with amounts ranging from $ to $10, unsecured personal loans vary by state: amounts. With no application or early repayment fees, a USAA Bank personal loan is a good alternative to using a higher interest credit card. We offer loans from $1, Personal Term Loan. Apply Now. 36 months. 60 months. $10, $15, %. %. $ $ Variable Rate Unsecured Lines of Credit. Product. Loan. We explain how to get a $ loan in six steps, including where to get a $ loan with bad credit. However, with stable income, no recent mispayments, and other positive factors, you may qualify for a $10, personal loan with a credit score below , but. Borrow from $2, up to $10,, without putting up collateral. Choose from multiple term options, up to 48 months. Get competitive rates, with great service. An example of a $10, unsecured personal loan: APR of %, month term, monthly payment of $ including principal and interest. Newfoundland and. What can a $10, personal loan be used for? You can use a $10, personal loan to finance almost anything from a new vehicle, to medical bills, funerals. What is the difference between an unsecured personal loan and a personal line of credit? A personal loan is a term loan with a fixed interest rate that is. Unsecured loan · Get access to credit faster with an expedited approval process · Borrow up to $, Bad Credit Personal Loans ARE HERE! Guaranteed Approval for in Canada in 24 hours! Apply today and get pre-approved in 20 minutes. With a personal loan, you borrow an amount of money for a period of time — say, $10, for five years. You get the full $10, to use immediately. With. A personal loan is an unsecured loan you can use to consolidate debt, pay for major expenses, and more. Check your rate for up to $ with Discover. We can help you get the $10, you need without any hidden fees. We offer unsecured loans with low interest rates and flexible repayment terms. Find out how. Most online lenders only offer unsecured personal loans. While the Personal Loan Calculator is mainly intended for unsecured personal loans, it can be used. If you need a small, unsecured loan, Oportun could be a good option. You can borrow as little as $ up to $10, with terms from one to years. An Unsecured Loan gives you the freedom of one lump sum to cover debt consolidation, home improvements or any unforeseen expenses at a fixed rate with no. An unsecured bad credit personal loans allows for same-day approval and next-day funding. Low, fixed interest rates. Our loans will cost you less than payday. Get prequalified for the best personal loan rate for you. Use our personal loans marketplace to get a loan for debt consolidation, major purchases and more.

Parent Plus Student Loan Repayment

Yes, if the parent dies, Parent PLUS Loans will be discharged. This is also the case in the death of the student on whose behalf the parent borrowed. The new loan is completely different from your old ones — with a new repayment term, interest rate, and monthly payment. And, if you had multiple student loans. Generally, you'll have from 10 to 25 years to repay your loan, depending on the repayment plan that you choose. Your required monthly payment amount will vary. A fixed interest rate; Can borrow amounts up to cost of attendance minus any other financial aid received; Flexible repayment options. Generally, you'll have from 10 to 25 years to repay your loan, depending on the repayment plan that you choose. Your required monthly payment amount will vary. Once you make qualifying payments on the new Direct Consolidation Loan, your loan may be forgiven (prior Parent Plus Loan payments do not count towards All PLUS Loans are eligible for the Standard, Graduated, and Extended Repayment Plans. Grad PLUS loans are also eligible for income-driven repayment (IDR) plans. Parent Plus Loans provide options for deferment or forbearance if you are struggling to repay, are eligible for forgiveness programs, and are dischargeable upon. You start repaying your loan once it's fully disbursed — or paid out — to the school for that academic year. The specific timeframe depends on the school. Yes, if the parent dies, Parent PLUS Loans will be discharged. This is also the case in the death of the student on whose behalf the parent borrowed. The new loan is completely different from your old ones — with a new repayment term, interest rate, and monthly payment. And, if you had multiple student loans. Generally, you'll have from 10 to 25 years to repay your loan, depending on the repayment plan that you choose. Your required monthly payment amount will vary. A fixed interest rate; Can borrow amounts up to cost of attendance minus any other financial aid received; Flexible repayment options. Generally, you'll have from 10 to 25 years to repay your loan, depending on the repayment plan that you choose. Your required monthly payment amount will vary. Once you make qualifying payments on the new Direct Consolidation Loan, your loan may be forgiven (prior Parent Plus Loan payments do not count towards All PLUS Loans are eligible for the Standard, Graduated, and Extended Repayment Plans. Grad PLUS loans are also eligible for income-driven repayment (IDR) plans. Parent Plus Loans provide options for deferment or forbearance if you are struggling to repay, are eligible for forgiveness programs, and are dischargeable upon. You start repaying your loan once it's fully disbursed — or paid out — to the school for that academic year. The specific timeframe depends on the school.

Repayment begins within 60 days after the full amount borrowed for a school year has been disbursed (around April 1 for a full-year loan). However, parents may. As a parent, you may be eager to help your child pursue their college education. Taking out a federal Parent PLUS loan is one way to ensure their college. The Income-Contingent Repayment Plan is the only income-driven repayment plan available to parent PLUS borrowers, and to repay your parent PLUS loans under the. Repayment plan options for Parent PLUS loans include Standard, Graduated, Extended, or Income-Contingent. Learn more about ICR and staying on track with income-. Eligible employees may be approved for a student loan payment of up to $10, ($5, is not taxed) per calendar year, paid directly to their loan provider. Eligible employees may be approved for a student loan payment of up to $10, ($5, is not taxed) per calendar year, paid directly to their loan provider. Yes, if the parent dies, Parent PLUS Loans will be discharged. This is also the case in the death of the student on whose behalf the parent borrowed. It is recommended it be done by each child's loan. Parent PLUS loans do not have the same repayment options as federal student loans. The Parent PLUS loans. Direct PLUS Loans are unsubsidized loans for the parents of dependent students and for graduate/professional students. PLUS Loans help pay for education. (a)(1)(B) and 5 CFR , an agency may specify in its agency loan repayment plan that it will not offer to repay PLUS loans under its student loan. Repayment of Parent PLUS Loans begins once the loan is fully disbursed to the school. · You can request deferment on repayment, but interest will accrue during. The purpose of a parent plus loan is to help the parent pay for the education, not the student. The parent agrees to pay off the loan. If they. As the parent, you must repay the loan even if your financial circumstances change or your student doesn't complete their degree. Parent PLUS Loan payments. Once you make qualifying payments on the new Direct Consolidation Loan, your loan may be forgiven (prior Parent Plus Loan payments do not count towards Parent student loans allow parents to help their children pay for a college education. There are two types of parent loans to choose from―federal parent PLUS. Parent PLUS loans are federal loans issued and managed by the U.S. Department of Education. These loans are available to parents of dependent undergraduate. Direct Federal Parents PLUS Loans are unsubsidized federal loans for the parents of dependent students. These loans allow parents to fill the gap between. Federal Direct Parent PLUS Loan: What is it? A credit-based loan with a fixed interest rate of %, with up front origination fees of % for loans. This loan allows parents of dependent students to borrow to pay for educational expenses. Financial need is not considered; therefore, the program is open. Direct PLUS Loans taken out by parents of dependent undergraduate student—known as parent PLUS loans—can help the student pay for college. The parent borrower.

Merge Facebook Accounts

I discovered an old FB account with my preferred username but have since been using a different account that doesn't have a username right now. Click the Yes, this is the same person button to merge the profiles. If the profiles contain different information in the same field, you'll be asked to. There are three ways to merge two Facebook accounts together — one is to request an account transfer, the second is to log into the other account and click the. If you want to merge your current account to a Facebook profile, phone number or an email address, there are a few easy steps to follow. You can only request a merge if you're an admin for both Pages. · The Pages you merge must represent the same thing and have similar names. · Merging Pages can't. Facebook account to log in. Because I can see that I have a Strava connection still active on my Facebook account from the same time I created my first account. If you have 2 Facebook Pages for the same thing, you may be able to merge them. We don't currently offer a way to merge two Facebook accounts. Learn more. If by chance you have more than one Facebook account, which goes against Facebook's Community standards, Facebook does not offer the ability to merge the. Unfortunately, merging accounts is not possible at the moment. However, marketers can request to merge Facebook accounts if they have an identical name or. I discovered an old FB account with my preferred username but have since been using a different account that doesn't have a username right now. Click the Yes, this is the same person button to merge the profiles. If the profiles contain different information in the same field, you'll be asked to. There are three ways to merge two Facebook accounts together — one is to request an account transfer, the second is to log into the other account and click the. If you want to merge your current account to a Facebook profile, phone number or an email address, there are a few easy steps to follow. You can only request a merge if you're an admin for both Pages. · The Pages you merge must represent the same thing and have similar names. · Merging Pages can't. Facebook account to log in. Because I can see that I have a Strava connection still active on my Facebook account from the same time I created my first account. If you have 2 Facebook Pages for the same thing, you may be able to merge them. We don't currently offer a way to merge two Facebook accounts. Learn more. If by chance you have more than one Facebook account, which goes against Facebook's Community standards, Facebook does not offer the ability to merge the. Unfortunately, merging accounts is not possible at the moment. However, marketers can request to merge Facebook accounts if they have an identical name or.

How I wish there was a way, but sadly Facebook has no way to merge two accounts (for now), as having two accounts is against the standards. I. You can merge the members of multiple groups into one group, as long each member is on your friend's list. Then, you'll need to manually merge the content. This is a problem that deals with connected component. Similar to account merge · Set up a dictionary · Use names as keys, and employee IDs as values · Iterate. How to Merge/Link Guest User Account with Facebook. Login using Play as Guest option Tap Gear icon in Lobby screen > Tap on 'Log in' option. To merge your Pages: 1. Log into Facebook, then click your profile photo in the top right. 2. Click See all profiles, then select the Page you want to switch. If you have task access to a Page, you can't merge Facebook Pages. If your Pages can be merged, your Page followers and check-ins from profiles will be combined. 4. Merging Facebook pages request · Go to “Settings” at the top of your page. · Tap on “General” · Scroll down to “Merge Pages” · Click on “Merge Duplicate Page”. If you have 2 Facebook Pages for the same thing, you may be able to merge them. At this time, you can't merge your Pinterest accounts. If you have more than one account you can either keep both accounts separately and switch between them. Merging One Account into Another · Check the box confirming you want to merge the accounts and click Merge. · You will be taken to the Accounts & Users page. You. How to Merge Two Facebook Accounts · Step 1: Bulk Download Your Facebook Data · Step 2: Restore Your Friends · Step 3: Restore Your Facebook Account Data · Step. If you have 2 Facebook Pages for the same thing, you may be able to merge them. You can connect one of your Facebook accounts to multiple Instagram accounts. Unfortunately, Facebook doesn't allow merging accounts into one. They prefer everyone to stick to a single profile for authenticity. Facebook is a community where people use their authentic identities. It's against the Facebook Community Standards to maintain more than one personal account. Facebook is a community where people use their authentic identities. It's against the Facebook Community Standards to maintain more than one personal account. In today's world of social media, it's important to have a clear online presence. Many people want to combine their different Facebook. Switching between Facebook accounts without logging anyone out is only available on pkcup-chita.ru on a computer. To switch accounts on an app or mobile. 1. Tap in the top right of Facebook. 2. Scroll down and tap Settings. 3. Tap Accounts Center from Settings page. 4. Tap Accounts. 5. Tap Add accounts and. How to Merge a Personal Facebook Ads Account with a Facebook Business Account · Click that big blue button that says “Add to Business” as shown in the image. In fact, merging pages together can actually boost your Facebook likes and followers. Read more: How to Merge 2 Facebook Accounts · How To Make Your Reel Go.

2 3 4 5 6 7 8 9